A Beginner’s Guide to Getting Your First Credit Score in India with No Previous History

Hey there! Welcome to my first blog post. Here, I’ll share the financial challenges I’ve faced in my life and how I effectively approached solutions—so you don’t have to waste time figuring things out the way I did.

The first thing to know when applying for a credit card is a term called CIBIL Score (the Indian version of a credit score, which is used worldwide). Think of a credit score as a record of all your previous loans, and the “score” reflects how timely you repaid them. In India, it ranges from 300 to 900. Read our guide to know your credit score: How to Check Your Credit Score in India for Free

If you’ve never taken a loan or credit card before, you won’t have a credit score. This makes it harder for lending companies to approve loans or issue credit cards, because they don’t know your repayment history and cannot assess your risk.

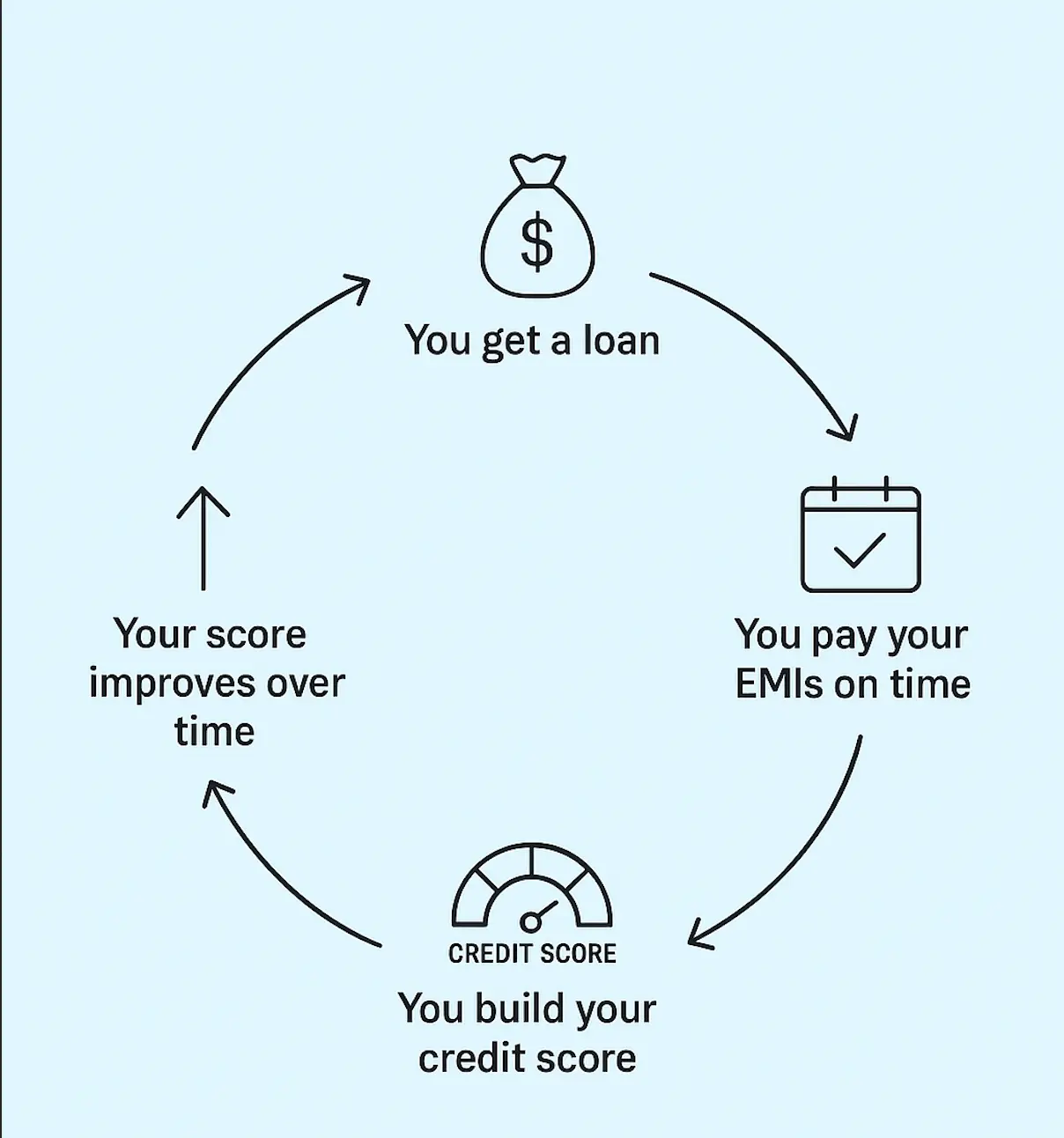

Think of it like a loop:

- You get a loan.

- You pay your EMIs on time.

- You build your credit score.

- Your score improves over time.

- You can then apply for more loans or credit cards with confidence.

But before you go into the 1 step above, you should already have a good credit score ♾️ 😀

Well, getting your credit score isn’t actually that hard. All over the internet, you’ll find countless articles claiming to guarantee a good score by following various “tricks.” But in this article, we’ll focus only on proven and simple tips to help you get your first credit score—or improve it if you already have one.

Personally, I maintained a CIBIL score of 850+ in India and Credit Score of 800+ in the UK, and I’ve always followed the steps mentioned below—so far, they’ve never failed me. This is also mentioned in my post: From 0 to Good Credit Score: My Journey to Building Credit History

Ok, enough about me—let’s get straight to the point.

3 Simple Steps for Beginners to Get Their First Credit Score

1. Get your first credit card

Getting your first credit card isn’t difficult if you have a bank account and haven’t taken any loans before. A simple way is to visit your home branch and ask about free credit cards available for your account, there are many credit cards available for beginners, either backed by a fixed deposit or offered free with savings accounts

Read about our post about : How & Which card to choose as 1st Credit Card for Students in India (No Credit Score)

If you don’t have a salaried account, the bank may ask for the purpose. However, if your savings or fixed deposit balance is good, they can easily issue a credit card to you—it doesn’t matter if your first card is VISA, Rupay, etc. Your initial goal is simply to get one.

Let’s be realistic: the bank can reject your request, saying they don’t offer cards for students or unsalaried individuals. That’s okay. One alternative is a fixed deposit (FD)-backed credit card. Many banks now issue credit cards based on a fixed deposit. For example, ICICI Bank and IDFC First Bank offer free FD-backed credit cards. The FD amount can start from as low as ₹5,000, and your credit card limit is usually based on the deposit amount.

So, you have two options:

- Get a credit card issued directly by your bank.

- Use an FD-backed credit card, which is often easier.

Tip: Avoid online-only credit cards like Kiwi or Jupiter for now if you don’t have any credit history. We’ll cover those options in detail later.

2. Apply for a Loan

The first step was easier because it was free, but this step involves paying interest. If you don’t want to go for a free credit card, the next option is to opt for a loan.

This step is generally for those who have some form of income—whether from a job, freelancing, or rental income. Getting a loan is harder than getting a credit card because it involves more paperwork.

I started my credit score journey with a loan of ₹2 lakh. Back in college, I had freelancing income, so my bank offered me an instant loan option through its mobile app. I decided to try it, and within seconds, the loan was credited to my account! It was for a year, and I had to pay 10% interest, but I never missed an EMI, and my credit score improved significantly as a result.

I recommend taking a loan only when you actually need money. Paying interest to a bank isn’t the best way to start your financial journey—unless you have a way to earn a higher return than the interest you’re paying, which is often difficult and risky.

Some smaller financial institutions can issue loans without checking your salary, but they charge high interest rates, sometimes around 16%. Missing any EMIs can seriously damage your credit score.

For example, if you want to buy a bike worth ₹1 lakh and don’t have a salary, these institutions may still approve up to 90% of the loan. They require only Aadhaar and PAN KYC, because they make up for the risk with higher interest rates, processing fees, and other charges.

Not to mention, you can also take a loan against a Fixed Deposit without visiting the bank—just through net banking or a mobile app. In my opinion, this is one of the safest ways to start building your credit score.

And yes, if you opt for any kind of loan, don’t miss any EMIs. I also recommend paying extra EMI whenever possible to reduce your interest burden. By doing this, you not only save on interest but also boost your credit score. You should read about our post on Top Mistakes Beginners Make with Their First Credit Card in India

3. Some More Ways

As we’ve covered the two major ways to get your first credit score, let’s look at some additional ways to increase your CIBIL score:

- Mobile Postpaid Connection – Postpaid mobile bills are reported to CIBIL and can impact your credit score. Make sure the connection is under your name.

- Internet Bills – If you have a postpaid internet plan, it’s considered a type of loan. Timely payments will help your credit history, while missed payments can hurt your score.

- Buy Now, Pay Later Services – Many companies allow you to purchase items and pay later, even if you don’t have a credit score. They report repayment history to CIBIL. Some popular options include Amazon Pay Later and ICICI Pay Later. Start with small amounts to build a positive record.

- Postpaid Wallets – Services like Ola Money Postpaid or similar wallets act as lenders and can contribute positively to your credit score when used responsibly.

- Utility Bills (Electricity/Water) – While not universally reported in India, paying bills on time in your name can help your financial reputation and is a good habit for building credit.

Tips to Use Your Credit and Loans Wisely

As you work hard to build your credit score, it’s equally important to maintain it—otherwise, having a good score won’t help and can even hurt you. A strong credit score can get you better interest rates on future loans, potentially saving you thousands. Here are some personal tips and hard rules I follow to maintain my credit score:

- Never, ever miss an EMI. Seriously, never.

- If you miss an EMI by a day or so, call your bank immediately, explain the situation, and ask them not to report it—mistakes or technical issues happen.

- Use your credit card for cashback and rewards only, not as a loan. Credit card interest rates can be insanely high, ranging from 16% to 40%.

- Pay your credit card bills in full as soon as they arrive. Don’t just pay the minimum amount.

- Avoid applying for multiple credit cards or loans in a short period. Hard checks on your credit score can reduce it, so try to stick with one credit card for at least a year.

- Keep your old credit cards active. The length of your credit history matters. Closing old cards and constantly opening new ones can hurt your score.

Follow these simple rules, and you’ll maintain a strong, healthy credit score over time.

See you next time 👋

We’ll keep updating this list as we discover more tips. You can also help by sharing your suggestions in the comments! Remember, this post is for beginners only.

For those who already have a credit score and want to improve it, we’ll cover that in our next blog. Don’t forget to subscribe to our email list to stay updated on personal finance tips—we promise, no spam!