How to Check Your Credit Score in India for Free in 2025

I’ve been talking about how to build your first credit score, get your first credit card, and the dos and don’ts of using credit cards & mistakes to avoid. But Recently, some users asked me to share a legitimate way to check their credit score (CIBIL score) in India.

In some countries, it’s pretty straightforward because only one or two companies handle all the data—for example, in the UK & some other counteries, you have Experian, Equifax, and TransUnion. You simply go to their websites, sign up, and you can view your history and score.

But India works a little differently, and that’s exactly what we’re going to talk about in this post. In India, there are four major credit bureaus that are approved by RBI and getting score/hostrory is also easier from them.

Steps to Check Your CIBIL Score (Credit Score) in India

In India, there are a few RBI-approved credit bureaus where you can check your score. Let’s start with the most popular one:

CIBIL (by TransUnion)

CIBIL is the most widely used platform in India. Not just individuals, but also private companies, banks, lenders, and even apps like Paytm rely on CIBIL to check a person’s credit history before approving a credit card or loan application.

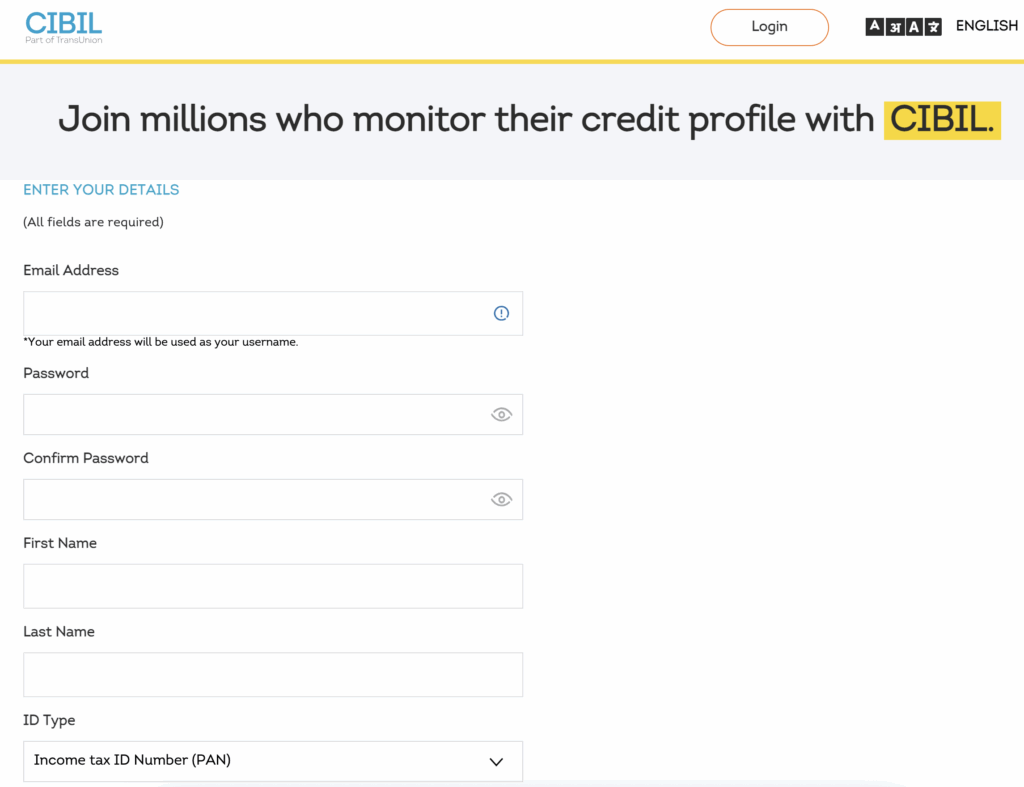

The process to get your credit score from CIBIL is pretty simple, Follow below steps:

- Go to the official CIBIL website – cibil.com.

- Click on “Get Your CIBIL Score.”

- Sign up or log in – If you’re new, you’ll need to create an account using your name, date of birth, PAN number, email, and mobile number.

- Verify your identity – You’ll receive an OTP on your mobile/email to confirm.

- Answer authentication questions – Sometimes CIBIL asks a few questions about your past loans or credit cards to confirm it’s really you.

- Access your report – Once verified, you can see your CIBIL score and download your credit report.

And You’re entitled to one free CIBIL report every year. If you want to check it more frequently, you’ll need a paid subscription.

Experian India

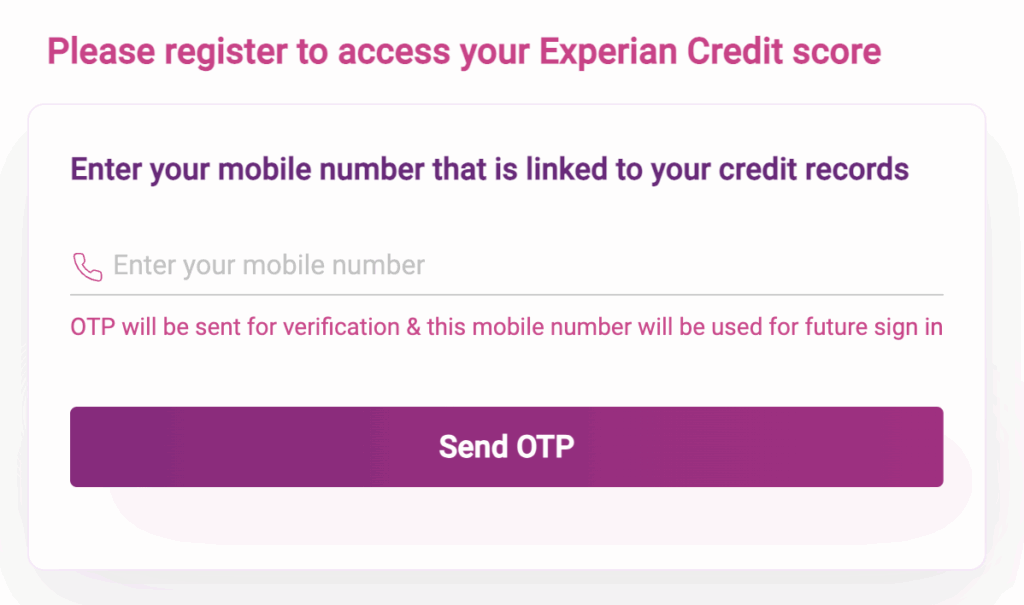

- Visit the Experian India website – experian.in.

- Click on “Get Your Free Credit Report and Score Now“.

- Sign up or log in – Enter your basic details like name, date of birth, email, mobile number, and PAN.

- Verify your mobile number – You’ll receive an OTP on your registered mobile number.

- Complete KYC verification – Experian may ask for additional details (like address or past loans/credit cards) to confirm your identity.

- View your score and report – Once verified, you’ll be able to see your Experian credit score and download your credit report.

In Experian as well (Just like CIBIL), you’re entitled to one free Experian credit report per year. If you need to track it regularly, they also offer paid plans.

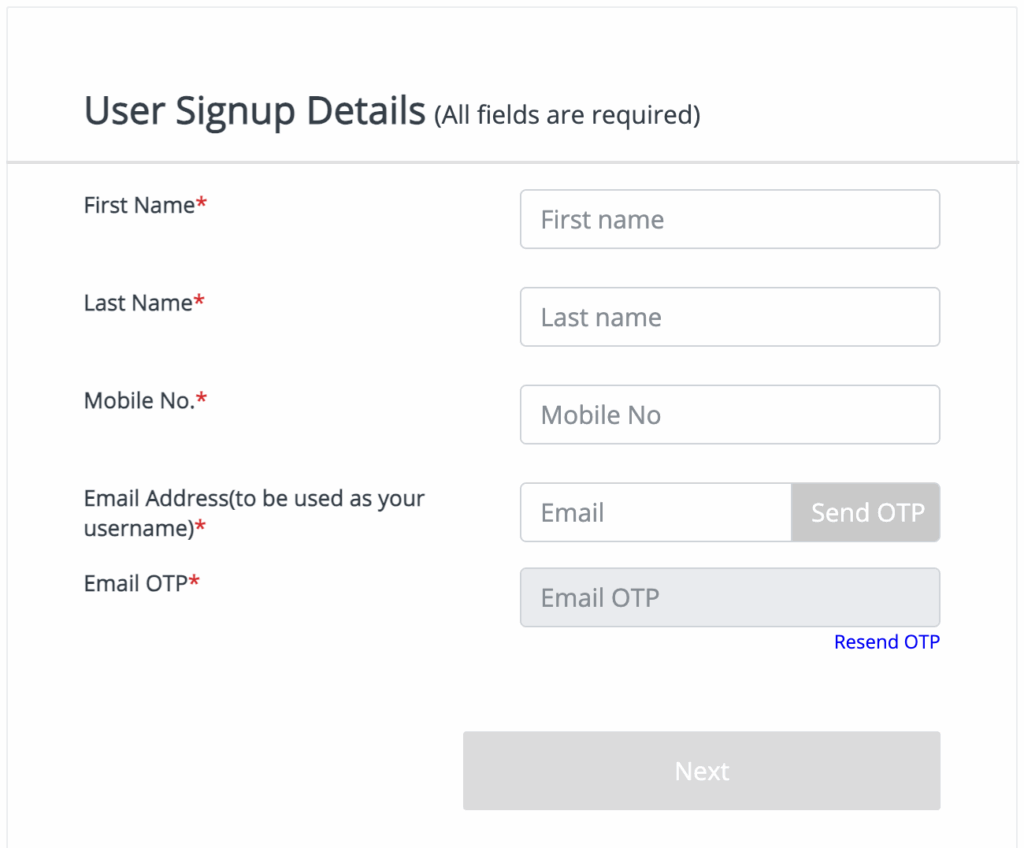

Equifax India Credit Score

- Go to the Equifax India website – equifax.co.in.

- Navigate to “Credit Report.”

- Fill in the request form – Enter details like your full name, date of birth, PAN, address, and mobile number.

- Submit identity proof – You may need to upload scanned documents such as PAN card or Aadhaar for verification.

- Verify your identity – OTP verification or document checks may be required.

- Receive your report – Once confirmed, Equifax will send your credit report (usually by email).

Like Experian and CIBIL, you can get one free Equifax credit report per year, as mandated by RBI.

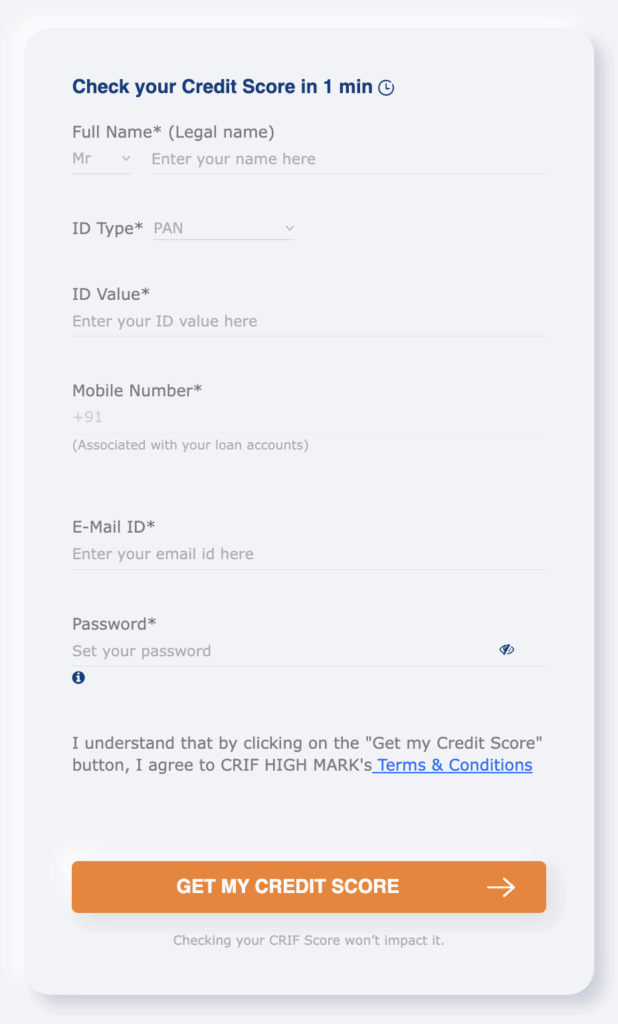

CRIF High Mark Credit Score

- Visit the CRIF High Mark website – crifhighmark.com.

- Click on “Get Free Score Now.”

- Register or log in – Provide your details such as name, date of birth, PAN, email, and mobile number.

- Verify with OTP – Enter the OTP sent to your registered mobile number.

- Answer authentication questions – Similar to other bureaus, they may ask about past credit accounts to confirm your identity.

- Access your score and report – Once verified, you can view and download your CRIF credit score and report.

Just like all above three services, CRIF also provides one free report per year, with paid options for more frequent access.

Note 1: All of the services listed above let you download your credit score for free, but each one pulls data from different bureaus. That means some reports may show more details, while others might miss certain information. Ultimately, when you apply for a credit card or loan, it’s up to the lender which bureau’s report they check — and your approval or rejection will depend on that.

Note 2: Checking your own credit score directly from an official bureau’s website does not impact your score. This is called a soft inquiry. However, when a bank or third-party company pulls your full report to evaluate you for credit, it’s considered a hard inquiry. Too many hard inquiries in a short time (for example, 5 in a month) can bring your score down.

Hard Check vs. Soft Check – What’s the Difference?

Soft Check (No Impact on Score)

- What it is: A soft check is when you or a company looks at your credit report for information only, not for lending decisions.

- Impact: Does not affect your credit score.

- Examples:

- You checking your own CIBIL score on cibil.com

- Checking score on Paytm, Cred, Paisabazaar, etc.

- A bank pre-approving you for a credit card offer without actually pulling the full report

Hard Check (Can Lower Your Score)

- What it is: A hard check is when a bank, lender, or credit card company pulls your full report to decide whether to approve your application. Example: Applying for multiple loans/cards in one month

- Impact: Too many hard checks in a short period can lower your score.

- Examples:

- Applying for a credit card at HDFC Bank

- Taking a personal loan from ICICI

- Applying for a car loan at SBI

Bonus: There are also other ways to check your credit score besides going directly to the RBI-approved bureaus. Many private companies and apps provide this service, but remember — they’re still pulling your data from the same official sources (like CIBIL, Experian, etc.).

You can either:

- Sign up on financial platforms like Paisabazaar, BankBazaar, or IndMoney, which fetch your report from CIBIL/Experian.

- Use your bank’s mobile app (ICICI, Kotak, HDFC, etc.) where some banks show your credit score inside net banking or mobile banking.

- Use UPI/payment apps like PhonePe, BharatPe, or Paytm, which also let you check your score for free.

So whichever method you choose, the actual score always comes from one of the four RBI-approved credit bureaus.

See you next time 👋

To sum it up, knowing your credit score is the first step to managing your financial health. Whether you check it on CIBIL, Experian, Equifax, CRIF, or through apps like Paytm and IndMoney, the important thing is to check regularly and keep track of where you stand.

Don’t forget to share in the comments which service you’ve used to check your credit score, and whether you’d recommend it to others.

Don’t forget to subscribe to our email list to stay updated on personal finance tips—we promise, no spam!