Expert guide to finding the best credit card based on your monthly spends

Excited to get a new credit card? But do you know you can actually lose money if you directly choose any cashback card? Yes, that’s right—credit cards don’t provide discounts across all purchase categories. Some cards may offer it, but the cashback will usually be very limited.

That’s why using a credit card aligned with your primary expenses is where you can generate the maximum cashback—whether it’s travel, dining, shopping, groceries, or EMI purchases.

In this post, we’ll first explore the best way to track your monthly expenses. Then, we’ll suggest the right category based on where you spend the most. Finally, we’ll calculate the cashback you could earn by choosing the correct credit card.

Let’s dive into today’s post on tracking your monthly expenses.

Some Proven Ways to Track Your Monthly Expenses

Manual Calculation

The simplest method is to calculate your monthly expenses manually, either using notes or an Excel sheet. However, this requires more manual effort—like digging through your last month’s bank statements, credit card bills, and even multiple bank accounts if you use them. Not just that, you may also need to check your yearly statements for bigger purchases and then break them down into monthly amounts to add to your expenses.

How to calculate manually ?

I would recommend to go with excel sheet, lets make an excel sheet (you can refer my google sheet for template), make sure to file-> make a copy and edit it in your google sheet.

Step 1: Start with Google sheet or Excel

Start by making a list of the most common expense categories, such as: (or use above given google sheet)

- Travel

- Bills & Utilities

- Groceries

- Shopping

- Food & Drinks

- Fuel

- Others/Misc

These categories cover almost all major types of monthly spending, and credit card companies also provide cashback based on these categories—so you’re already aligned with their reward structure.

Step 2: Enter Your Expenses

Once your Excel sheet is ready with categories and columns, the next step is to record every expense you make. This step is crucial because the more accurate your data, the better your insights will be.

Here’s how to do it:

- Pick the right category

- Every time you spend, ask yourself: Which bucket does this expense belong to?

- Example:

- A flight ticket → Travel

- Electricity bill → Bills & Utilities

- Groceries from BigBasket → Groceries

- Dinner at a restaurant → Food & Drinks

- Enter the amount spent

- Type the exact amount in the Actual Expense (₹) column.

- Don’t round off; even small numbers matter when you total them at the end of the month.

- Add a description

- Write a short note in the Description column so you remember where the money went.

- Example: Ola, Internet Bill, Amazon, Zomato, HPCL fuel, etc.

- Record the date

- In the Date column, enter the date of the transaction.

- This helps you track not just what you spent, but also when you spent it.

- Be consistent

- Make it a habit to enter expenses daily or at least weekly.

- If you leave it for the end of the month, you may forget some small but important spends.

- If you’re doing this for the first time, that’s perfectly fine. Just record your last month’s expenses, and we’ll figure out the best credit card to apply for based on that.

Step 3: Calculate Totals

At the end of each category, you will see a Total row. Use the SUM formula in Excel to quickly calculate the total spend in that category or you can do it manually. Repeat the same for all categories so you have the totals ready.

Step 4: Find Your Highest Spend

Now, compare the totals across categories. The one with the highest total is your biggest spending area for the month.

This insight is powerful—because the right credit card can give you the maximum cashback or rewards in that very category, whether it’s fuel, travel, groceries, or shopping.

Automatic Spend Calculation – Expense Tracker Apps

I personally don’t use expense tracker apps because I make most of my payments with a credit card. For offline payments, I usually go with RuPay UPI, and if RuPay isn’t supported, I simply use my Visa card on the swipe machine to complete the purchase. For smaller spends, I switch to a UPI app linked to my bank account if the merchant doesn’t accept RuPay credit cards.

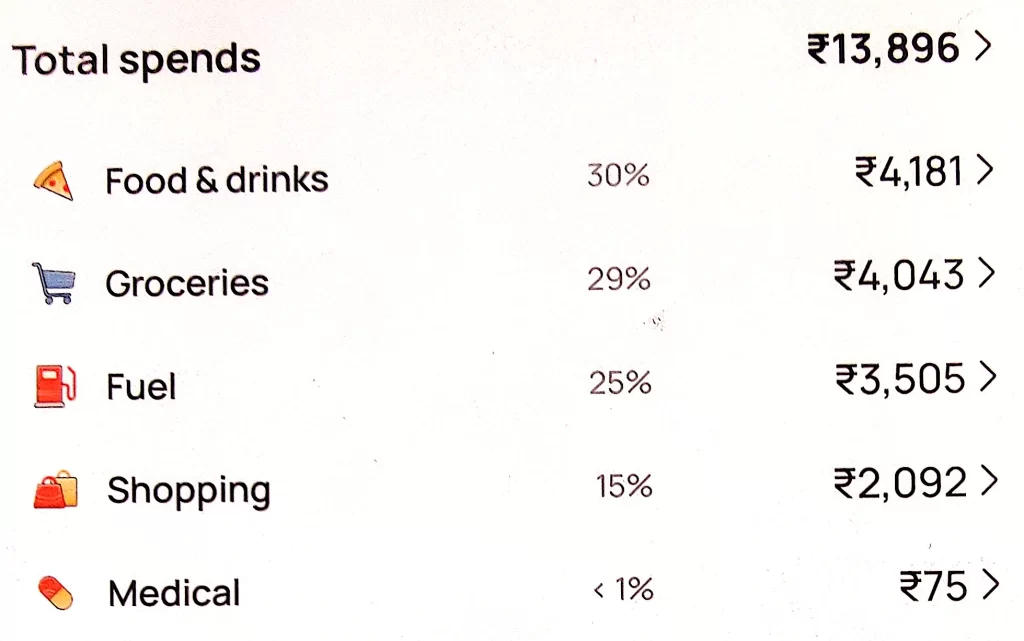

When you use a credit card for most of your payments, the credit card app itself usually provides spend tracking. For a few months, I used the Jupiter Edge + RuPay Credit Card, and I found their app quite effective for tracking expenses. Here’s a screenshot above.

If you mostly use your bank account and UPI for transactions, I believe manual calculation works better. Still, if you prefer relying on expense tracking apps, you can easily find many options on Google. Just keep in mind, there’s always a risk of data theft, which is why I personally avoid them.

How to Choose a Better Credit Card

After identifying the category where you spend the most—or perhaps two or three categories based on your monthly expenses—the next step is to choose a credit card. You can pick from the suggestions listed below. In this post, I am only providing some card names, and you should do your own research by visiting their official websites before applying.

Some of the cards I have already reviewed on Credit Card Offers & Rewards, feel free to take a look.

Credit Cards to Consider by Category

Travel: Axis Atlas, HDFC Regalia, Axis Bank Magnus Burgundy, ICICI Emeralde Metal, SBI Card Prime, American Express Platinum Travel, Standard Chartered EaseMyTrip, Yatra SBI Card, MakeMyTrip ICICI Bank, 6E Rewards XL IndiGo HDFC, Club Vistara SBI

Bills & Utilities: Axis Bank ACE, Airtel Axis Bank, HDFC Diners Club Cashback, ICICI Platinum Chip, SBI Card Unnati, YES Bank Paisabazaar PaisaSave, Amazon Pay ICICI Bank, etc. Find out latest list here: Best Credit Cards for Utility and Bill Payments Online

Groceries: HDFC Swiggy Credit Card, HSBC Live+, SBI SimplyCLICK, ICICI Amazon Pay, Axis Bank Insta Easy, Kotak Delight, etc. I have also written a post about it here: Best Credit Card for Blinkit, Zepto, BigBasket & Offline Grocery Stores in India

Shopping: Flipkart SBI Credit Card, Tata Neu Infinity, Axis Bank My Zone, ICICI Platinum Chip, HDFC Freedom, Amazon Pay ICICI, Titan SBI Credit Card, Jupiter CSB Edge+ etc. Checkout updated list here: Best Credit Cards for Online Shopping on Amazon, Flipkart, Myntra & More

Food & Drinks / Dining: Swiggy HDFC Bank, EazyDiner IndusInd, HSBC Live+, ICICI Diners Club, Axis Bank Privilege Dining, PVR INOX Kotak, RBL Bank Play Credit Card, etc

Fuel: HPCL IDFC FIRST Power, IndianOil Axis Bank, SBI BPCL, ICICI Coral, RBL Bank XTRA, Axis Bank Miles & More. Checkout more here: Best credit cards for Fuel , Petrol, Diesel – Updated list in 2026

Others / Misc: Axis Bank ACE, HSBC Live+, YES Bank Paisabazaar PaisaSave, ICICI Platinum Chip, HDFC MoneyBack, Tata Neu Infinity, IDFC FIRST Bank Credit Cards, etc

I will try to update the list and add official links after reviewing each card in an upcoming post. Make sure to subscribe to learn about the cashback of each card and avoid getting stuck with a low-reward or bad cashback card.

Cashback You Can Earn by Choosing the Right Card

Some co-branded cards can give up to 25% cashback (for example: Airtel Axis Bank Credit Card on Airtel bill payments), which means you save ₹25 on a ₹100 payment. However, there is usually a monthly cap to prevent excessive payouts.

For most categories, you can expect up to 10% cashback, depending on the card if it’s targeted for that category. Let’s see an example of how much you could earn based on your spending:

- Grocery Purchase – ₹3,000 → ₹300 cashback via HSBC Live+ (example)

- Shopping – ₹9,000 → ₹900 cashback via Jupiter Edge on Amazon (example)

Similarly, if you spend ₹15,000 across other categories, you could aim for ₹1,500 cashback using different cards. The key is to know which card gives how much cashback for each category.

In this example, you are earning 10% cashback by using the right card at the right merchants. That’s why it’s important to track where you spend the most and choose the card(s) that provide the maximum cashback in those categories. Often, you may need multiple cards, because no single card can deliver top cashback across all categories.

Also read: Top Reward-Paying RuPay Credit Cards – Expert Picks

See you next time 👋

Using the right credit cards for different purchases is the key to earning maximum cashback on your everyday spending. Always track your spending, choose cards that match your habits, and use them responsibly. This way, your daily expenses start saving you money instead of just costing you.

Stay tuned for unbiased reviews of different cards in upcoming posts. That’s why don’t forget to subscribe using the form below.