Jupiter Edge+ CSB RuPay Credit Card Review – Worth It or Overhyped?

I have been a continuous user of the Jupiter RuPay credit card since its launch (approximately 2 years ago) and recently upgraded from the Edge to the Edge+ variant. At first, it seemed like a downgrade, but over time it has proven to be more beneficial to me but not necessarily to you. In this post, we will discuss whether it is worth applying for this card, if it is just overhyped online, and whether any better alternatives exist in this lifetime-free category. Let’s explore in detail about Jupiter Edge+ CSB RuPay Credit.

Jupiter Edge+ Credit Card Overview & Perks

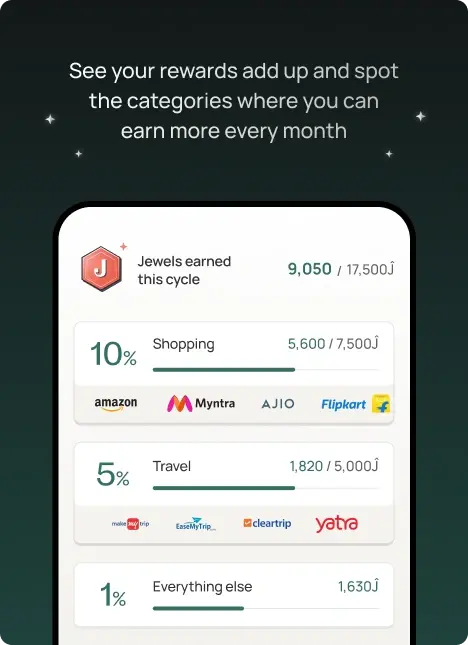

The Jupiter Edge+ is a co-branded RuPay credit card powered by CSB Bank. This means you can pay merchants via UPI using your phone (if they’ve enabled it). In return, it offers guaranteed cashback in points called Jewels (5 Jewels = ₹1). You can use these Jewels to pay your credit card bill, purchase Amazon or Flipkart gift vouchers, or buy digital gold. Personally, I use my Jewels to pay off my bill, and the conversion to cash reflects instantly on my statement—it’s super quick.

How Much Cashback Can You Earn with Jupiter Edge+ CSB RuPay Card?

I’ve been using the Jupiter Edge+ card for over 2 years, and it’s one of the few RuPay cards that consistently delivers guaranteed cashback across multiple categories. Here’s a breakdown:

1% Cashback Everywhere

- Earn 1% cashback on all payments via UPI, card, or offline merchants.

- There are no earning limits, unlike many other RuPay cards.

- Even banks like SBI or HDFC often don’t guarantee 1% on all transactions.

10% Cashback on Online Shopping

- Get 10% cashback in Jewels when shopping on Amazon, Flipkart, Myntra, and other platforms.

- Example: Spending ₹1,000 earns 500 Jewels, which converts to ₹100 cashback.

- Monthly cap: Up to ₹5,000 per platform, resetting each statement cycle.

- No minimum cart value required.

- According to Jupiter’s official FAQ, Jewels can be redeemed against your credit card bill, Amazon/Flipkart gift vouchers, or digital gold.

5% Cashback on Travel

- Earn 5% cashback in Jewels on bookings via MakeMyTrip, Goibibo, Yatra, Cleartrip, and IRCTC.

- Example: Spending ₹2,000 earns 200 Jewels → ₹40 cashback.

- This makes the card ideal for frequent travelers, and I’ve personally found it very useful when booking flights and hotels.

Tip: Keep in mind the cashback is credited in Jewels, not cash, so you’ll need to redeem them to see the actual value on your statement.

Eligibility, Application Process & Fees

Eligibility & Application Process

To apply for the Jupiter Edge+ card, you need :

- Age: 18–65 years

- Documents: Valid PAN and Aadhaar

- Income: Must meet minimum bank criteria

- Application: Fully digital via Jupiter app – fill details, complete KYC, and submit

- Delivery: Card arrives at your doorstep within a few days

- Convenience: Easy for first-time and experienced credit card users but need good credit score

Fees & Charges:

- The Jupiter Edge+ card is lifetime free, so there’s no annual fee.

- Joining fee can be 500 rs or Free depending on the offers running.

- Standard interest rates apply on unpaid balances.

- Late payment fees and other charges are minimal, but it’s always good to check the latest fee schedule on the bank’s website.

How to Use Jupiter Edge+ to Get Maximum Cashback

The Jupiter Edge+ card rewards you in Jewels, which can be redeemed for your credit card bill, Amazon/Flipkart gift cards, or digital gold. Here’s a practical example to show how you can maximize your rewards:

Example Monthly Spending

| Category | Spend | Cashback % | Jewels Earned | Equivalent Cashback (₹) |

|---|---|---|---|---|

| Amazon | ₹5,000 | 10% | 2,500 | ₹500 |

| Flipkart | ₹5,000 | 10% | 2,500 | ₹500 |

| Myntra | ₹5,000 | 10% | 2,500 | ₹500 |

| Cleartrip (Travel) | ₹10,000 | 5% | 2,500 | ₹500 |

| Other Purchases (Offline/UPI) | ₹10,000 | 1% | 500 | ₹100 |

| Total | ₹35,000 | — | 10,500 Jewels | ₹2,100 |

Note: 5 Jewels = ₹1, so the total Jewels (10,500) = ₹2,100 cashback.

Tips to Maximize Cashback

- Focus on online shopping platforms – Amazon, Flipkart, Myntra give 10% cashback, so try to allocate your online spend there.

- Use the card for travel bookings – Cleartrip, MakeMyTrip, Yatra, Goibibo, and IRCTC earn 5% cashback.

- Use it for daily offline/UPI payments – While only 1%, it adds up over the month.

- Redeem Jewels smartly – Pay off your credit card bill first, then use remaining Jewels for gift vouchers or digital gold.

- Plan around monthly caps – Online shopping cashback has a ₹5,000 per platform per month limit. Spread your purchases accordingly.

Final Verdict – Worth It or Overhyped ?

The Jupiter Edge+ CSB RuPay card isn’t just hype—it offers real value, but its usefulness depends on your spending habits.

Worth It For:

- Frequent online shoppers – Maximize the 10% cashback on Amazon, Flipkart, and Myntra.

- Travel enthusiasts – Benefit from 5% cashback on flights, hotels, and train bookings via platforms like Cleartrip, MakeMyTrip, or IRCTC.

- First-time credit card users – Lifetime-free and easy digital onboarding makes it low-risk.

- People who redeem cashback smartly – Jewels can be used for bill payments, gift vouchers, or digital gold, so savvy users get maximum value.

Potentially Overhyped For:

- High offline spenders – Only 1% cashback on offline/UPI payments may feel low.

- Users who prefer instant cash – Cashback comes in Jewels, not direct cash, which might be inconvenient for some.

- Very high spenders – Monthly caps on 10% online shopping cashback (₹5,000 per platform) could limit rewards for big spenders.

See you next time 👋 The Jupiter Edge+ CSB RuPay card is best positioned as an online shopping and travel rewards card. Its 10% cashback on major e-commerce platforms and 5% cashback on travel bookings make it ideal for those who spend heavily in these categories. Must read: Expert guide to finding the best credit card based on your monthly spends

The lifetime-free nature, combined with the flexible Jewels redemption system (bill payments, gift vouchers, digital gold), makes it low-risk and highly practical. If your lifestyle revolves around online shopping and travel, this card turns everyday spending into meaningful, redeemable rewards.