No-Cost EMI: Is It Really Free? My Experience Using It

In this article, we will explore the pros and cons of using No-Cost EMI, which many people opt for during sales seasons on e-commerce websites like Amazon or Flipkart. We’ll look at a real-life example of a purchase I made using No-Cost EMI with an HDFC Bank credit card. We will also discuss when it makes sense to use No-Cost EMI and when it’s better to avoid it by examining hidden costs and interest. Finally, we’ll answer the question: is it really “No-Cost”?

What Is No-Cost EMI & Why E-Commerce Platforms Promote it

No-Cost EMI means you don’t pay any extra interest on your credit card if you buy a product on EMI. In simple words, you don’t need to pay the full price upfront, and you don’t get charged interest either. It sounds like a win-win situation, but we’ll look deeper to see if it’s really that straightforward.

So, who actually bears the interest on EMIs? Technically, it’s still you—but the trick is that merchants (like Amazon or Flipkart) adjust the price in a way that makes it look free.

For example, suppose you buy a product worth ₹100 on a 12-month No-Cost EMI. Normally, you’d pay around ₹20 as interest. Instead, the merchant gives you an upfront discount, reducing the effective sale price to ₹80. That way, when you pay ₹20 as interest plus ₹80 for the product, the total still comes to ₹100.

E-commerce merchants offer No-Cost EMI to boost their sales and make it easier to sell high-value items. They usually partner with credit card companies to run these schemes. The merchant provides a discount to the customer, while the bank still earns back the interest amount from the customer’s EMI payments. In return, banks share a portion of their profits with the merchants, making it a win-win for both sides.

My Experience: Buying products on No Cost Emi

Recently, I bought a washing machine on Flipkart that was listed for ₹19,000. However, if someone purchased it using a credit card or Credit Card EMI, they could reduce the price by ₹5,000—around a 25% discount—just by opting for No-Cost EMI.

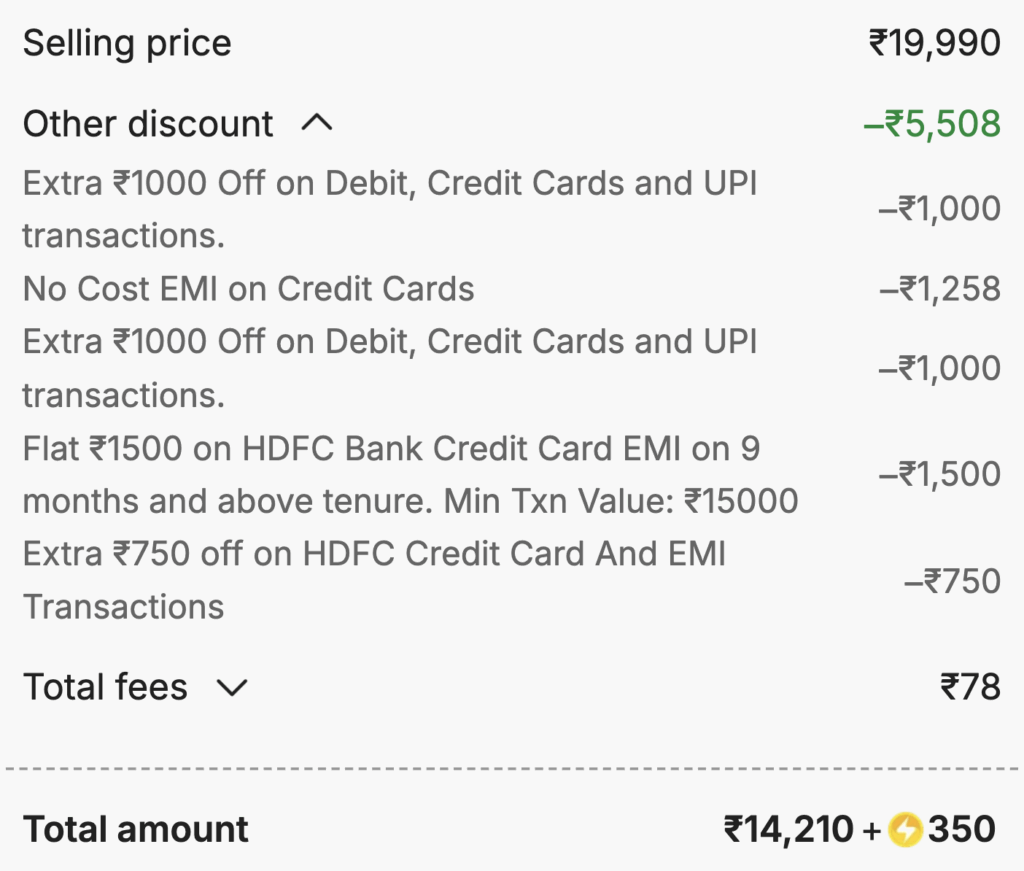

Let’s check out the breakdown of my invoice, which shows the details:

- If I purchase this washing machine via Cash on Delivery, it would cost me around ₹19,990, with no discounts applied.

- But if I use a Debit or Credit Card, I get an instant ₹1,000 off, bringing the price down to ₹18,990.

- If I opt for a No Cost EMI on Credit Card, the effective price becomes ₹18,732, factoring in the EMI structure.

- Using an HDFC Credit Card EMI for 9 months or more gives me an additional ₹1,500 off, making the price ₹17,490.

- And if I combine that with an extra ₹750 off on HDFC Credit Card transactions, the final price drops to ₹16,740.

- After applying all eligible offers and discounts, the lowest effective price comes to around ₹14,210 + ₹350 fee, totaling ₹14,560.

It means the No Cost EMI gave me an additional discount of ₹1,258 (Lets round off to 1.25k), which essentially covers the interest I would have paid over a year. Instead of charging it, they deducted that amount upfront from the final price.

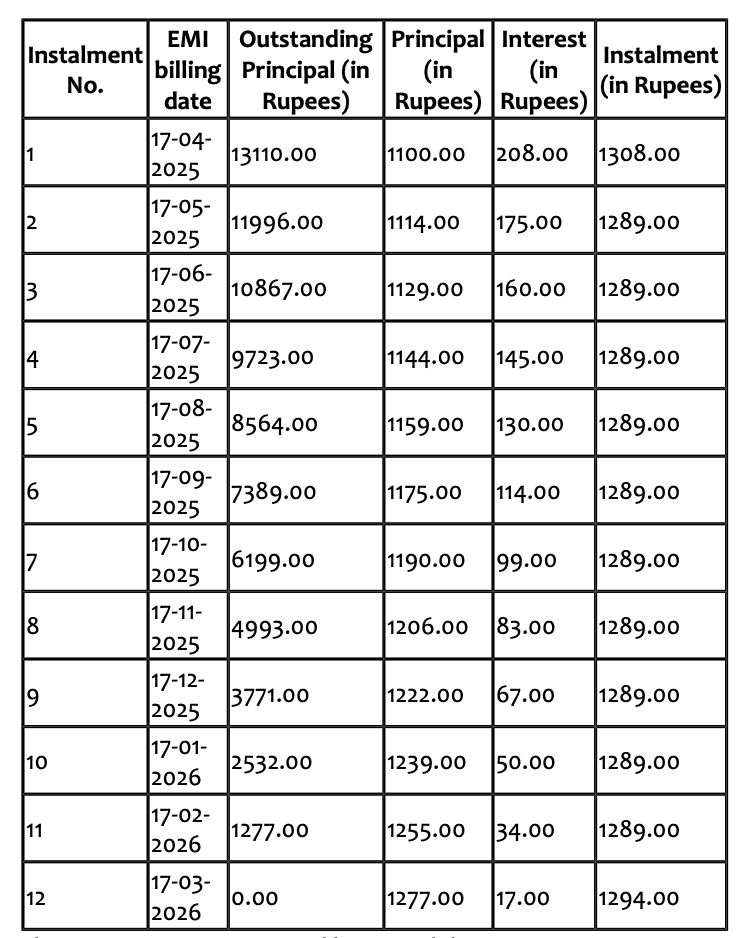

Now let’s checkout my credit card bill and total amount I would need to pay:

After totaling all the EMIs, the final cost of the washing machine comes to ₹15,825.82. This includes the interest charged over the EMI period and the GST applied on that interest.

GST Paid: approx ₹300, Processing Fee: approx ₹300

Although I received a No Cost EMI discount of ₹1,258, the actual interest charged was ₹1,292. When you add the processing fee and GST, the total extra cost becomes ₹1,292 + ₹300 + ₹300 = ₹1,892. That’s ₹634 more than the discount I received—so technically, I ended up paying ₹634 extra despite the ‘No Cost EMI’ label.”

Summary of No-Cost EMI Calculations for the Above Purchase

Here’s how it played out:

- Base Price of Washing Machine: ₹14,210

- EMI Tenure: 12 months

- Monthly EMI: ₹1,289

- Total Interest Paid: ₹1,292

- Processing Fee: ₹299 + GST = ₹352.82

- GST on Interest: ₹232.56

- GST on Final EMI: ₹17

- Total Paid Over 12 Months: ₹15,825.82

So while I received ₹1,258 as a discount for choosing No Cost EMI, I ended up paying:

- ₹1,292 in interest

- ₹300+ in processing fees

- ₹300+ in GST

Total extra cost: ₹1,892 Net loss compared to the discount: ₹634

Bottom line: Even with a “No Cost EMI” label, I paid ₹634 more than I would have with a direct purchase. The interest and GST are real—they’re just bundled differently.

My Verdict on No-Cost EMI

No-Cost EMI comes with both pros and cons, and whether you should opt for it depends on your situation. Here’s my take:

You Should Opt for No-Cost EMI When:

- You are getting extra discounts by choosing No-Cost EMI.

- You want to buy the item on EMI because you don’t have the full amount upfront.

- You have the money but it’s earning more elsewhere—for example, your savings or investments are generating returns higher than the GST and processing fees.

- You want to improve your credit history by paying EMIs on time, which can help your credit score.

- You prefer cash flow flexibility—spreading payments over months can make budgeting easier.

You Should Avoid No-Cost EMI When:

- There’s no real discount for choosing No-Cost EMI, and paying via credit card upfront gives a better deal.

- You want to avoid GST or processing fees, especially if you can pay the full amount upfront without losing potential returns.

- You don’t want the hassle of monthly payments, or you are not confident in tracking EMIs on time.

- You tend to overspend—EMIs can make it tempting to buy bigger-ticket items unnecessarily.

So, choosing No-Cost EMI isn’t inherently good or bad—it really depends on your financial situation. Sometimes it can be very beneficial, and other times it may not be the best choice.

Must Read: Top Mistakes Beginners Make with Their First Credit Card in India

See you next time 👋

There’s a lot of confusion on the internet, with people sharing both good and bad opinions about No-Cost EMI. I hope this article has helped you make a more informed decision. From now on, whenever you see a No-Cost EMI option, make sure to do your calculations just like I demonstrated above, and then choose the option that best fits your personal finances.

Let me know in the comments what you think about it—would you recommend it, or what’s your take on it? See you in the next post, where we’ll explore more tips on managing your money wisely.